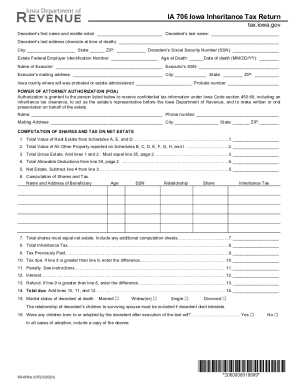

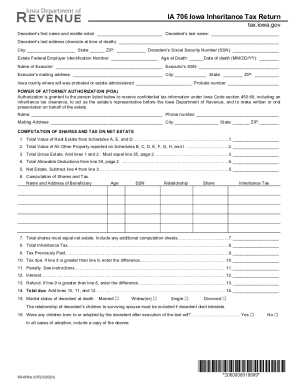

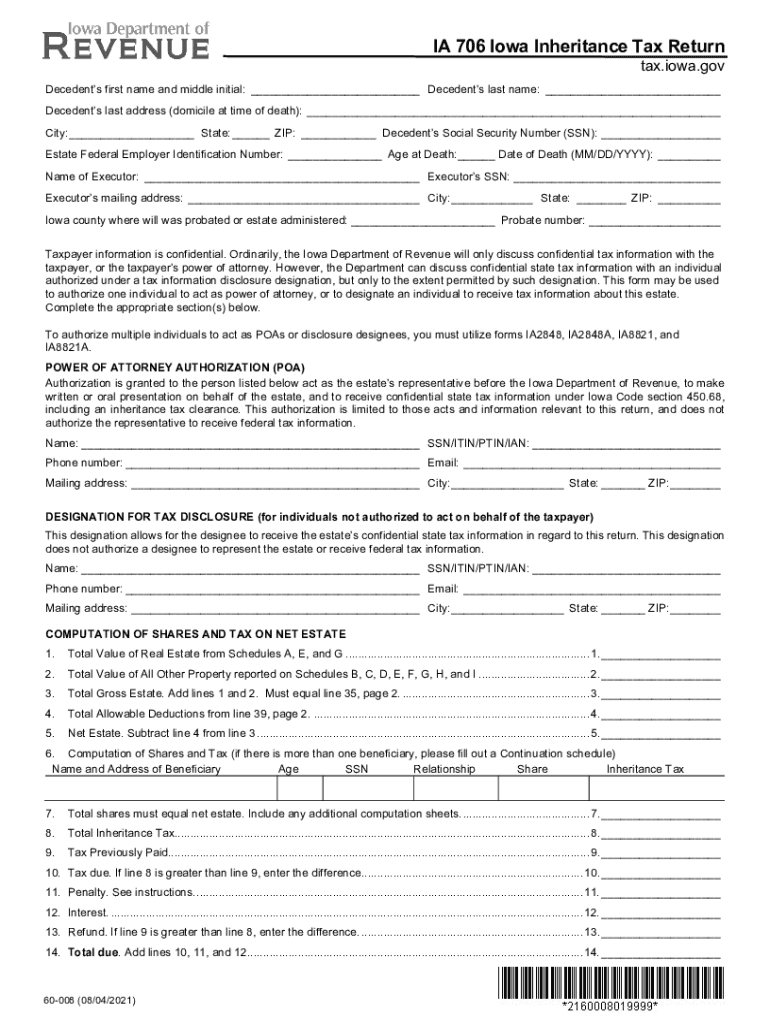

iowa inheritance tax form

150001-and more has an Iowa inheritance tax rate of 10. There are also Tax Rate F beneficiaries which are unknown heirs and their tax rate is 5.

Form 2848 Instructions For Irs Power Of Attorney Community Tax

Change or Cancel a Permit.

. Stay informed subscribe to receive updates. Rescinded IAB 101393 effective 111793. Complete Iowa Ia 706 Inheritance Tax Return Only - State Legal Forms online with US Legal Forms.

A summary of the different categories is as follows. Estates of decedents dying prior to July 1 1983. Iowa Inheritance Tax Schedule A 60-002.

Read more about Inheritance Deferral of Tax 60-038. All Will forms may be downloaded in electronic Word or Rich Text format or you may order the form to be sent by regular mail. Iowa Inheritance Tax Checklist.

Register for a Permit. General Instructions for Iowa Inheritance Tax Return IA. Easily fill out PDF blank edit and sign them.

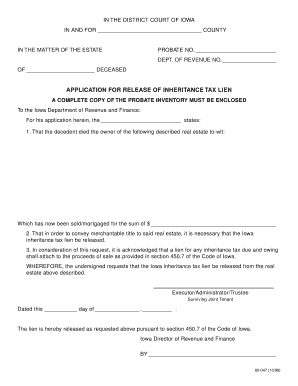

Learn About Sales Use Tax. Iowa InheritanceEstate Tax - Consent and Waiver of Lien 60-014. Save or instantly send your ready documents.

Change or Cancel a Permit. Adopted and Filed Rules. Iowa InheritanceEstate Tax Return IA 706 Step 1.

Therefore the signNow web application is a must-have for completing and signing iowa inheritance tax form 2011 112862 on the go. Learn About Property Tax. Inheritance tax clearance will be issued by the Department.

Adopted and Filed Rules. It may be necessary to file additional documents with the inheritance tax return if requested by the Department. 12501-25000 has an Iowa inheritance tax rate of 6.

Law. Iowa Inheritance Tax Schedule J 60-084. 75001-100000 has an Iowa inheritance tax rate of 8.

Inheritance Deferral of Tax 60-038. Track or File Rent Reimbursement. Also Mutual Wills for Married persons or persons living together.

25001-75500 has an Iowa inheritance tax rate of 7. Probate Form for use by Iowa probate attorneys only. In 2021 Iowa decided to repeal its inheritance tax by the year 2025.

Form and content - inheritance tax return. File a W-2 or 1099. This is a tax on the right to receive money or property owned by the decedent at the time of death.

Adopted and Filed Rules. This document is found on the website of the government of Iowa. So if you inherit property from a relative or friend in Iowa you could be subject.

Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now. Report Fraud. Schedule B beneficiaries include siblings half-siblings sons-in-law and daughters-in-law.

Iowa is one of several states that have an inheritance tax. 100001-150000 has an Iowa inheritance tax rate of 9. Tax Rate D and Tax Rate E beneficiaries are for various types of organizations.

In the meantime there is a phase-out period before the tax completely disappears. The Iowa inheritance tax rate varies depending on their relationship of the inheritors to the deceased person. Swiftly create a Iowa Ia 706 Inheritance Tax Return Only - State Legal Forms without needing to involve experts.

Personal representative means an administrator. Wills for married singles widows or divorced persons with or without children. An Iowa inheritance tax return must be filed if estate assets pass to both an individual listed in Iowa Code section 4509.

IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. And that individuals spouse. Adopted and Filed Rules.

Report Fraud. Stay informed subscribe to receive updates. We already have over 3 million users.

Report Fraud. The document has moved here. To pay inheritance and estate tax in the state of Iowa file a form IA 706.

If a federal estate tax return form 706 United States Estate Generation-Skipping Transfer Tax Return is filed a copy of that return must be filed with the inheritance tax return. If the net value of the decedents estate is less than 25000 then no tax is applied. Form 706 United States Estate Tax return _____ required to be filed as a result of the death of the Decedent.

Learn About Property Tax. File a W-2 or 1099. It is different from the federal estate tax which applies on the total value of the estate.

Register for a Permit. The personal representative is required to designate on the return who is to receive the clearance. In a matter of seconds receive an electronic document with a legally-binding eSignature.

The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15. Get iowa inheritance tax form 2011 112862 signed right from your smartphone using these six tips. Up to 25 cash back Update.

Learn About Sales. Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. If the return fails to designate a recipient the clearance will be sent to the clerk of district court designated on the return.

Enter the decedents name date of death age at the time their address at the time of death and federal identification and Social Security numbers. Track or File Rent Reimbursement. Wills include State Specific forms.

Adopted children biological children entitled to inherit under the laws of Iowa stepchildren and grandchildren great-grandchildren and other lineal descendants are exempt from Iowa inheritance tax 5. Read more about Inheritance Tax Rates Schedule. For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out.

Tax Credits. 0-12500 has an Iowa inheritance tax rate of 5.

Free South Dakota Small Estate Affidavit Form Pdf Word

Nebraska Income Tax Ne State Tax Calculator Community Tax

Inheritance Release Form Fill Online Printable Fillable Blank Pdffiller

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Calculating Inheritance Tax Laws Com

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Probate Case Status Report And Order Pdf Fpdf Docx Illinois

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Inheritance Tax 2022 Casaplorer

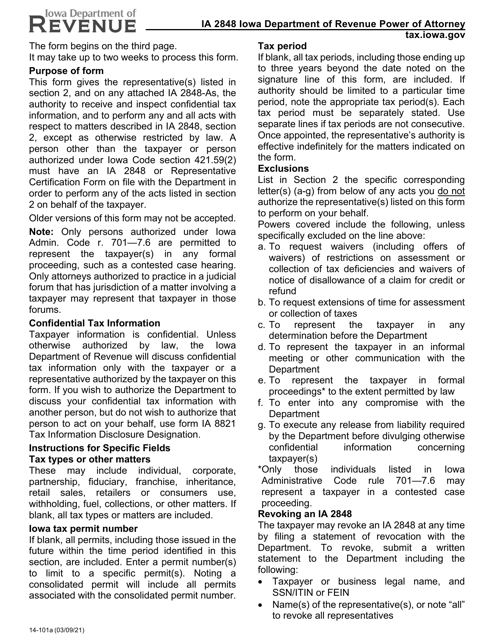

Form Ia2848 14 101 Download Fillable Pdf Or Fill Online Iowa Department Of Revenue Power Of Attorney Iowa Templateroller